IR35

This will mean that from 6 April 2023 contractors working for an organisation via an intermediary will once again be responsible for determining their employment status and paying the appropriate amount of tax and national insurance. IR35 was introduced to identify disguised employees and ensure they pay the correct amount of tax.

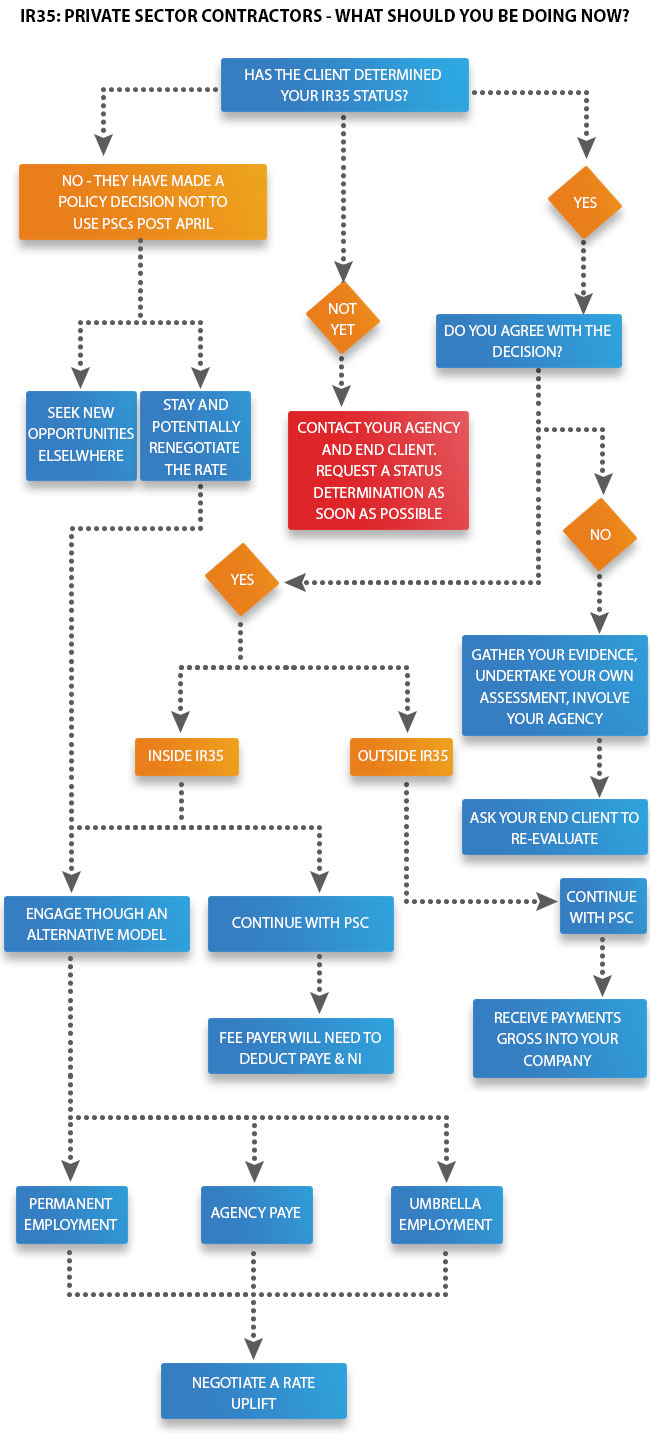

Working Through Hmrc S Off Payroll Ir35 Rules A Step By Step For Pscs

The client is the organisation who is or will be receiving the services of a contractor.

. U E½zÈHIëíጠ5 eáüý ø FÙbµÙ NÛãõñõóŸújüVS ÃÙŒ EJe NœµlÄؾ H À hfö¾oÞRûö³¾øDáþáA éê Ïî Ýžþ z 8JPe šR f Ÿ³A¾A²Q¼Qÿoi9 f óÈx Ê dyoæªUUWªªqÔÝÏ Ñé Hqì½oêW5ÐÝÉ r Æ8ŽcieìÚ R. There is a very good chance that due to an abundance of caution many more assignments will be deemed inside IR35 use the IR35 calculator to make sure you are getting the best returns from these contracts. These rules are sometimes known as IR35.

IR35 - Deemed Payment Calculator 200001 200102 200203 200304 200405 200506 Enter payments or benefits received by the worker or his family in respect of the relevant engagements from anyone other than the intermediary which are not otherwise chargeable to income tax as employment income. Reforms to the off-payroll working rules known as IR35 are to be scrapped from April 2023 the Treasury has announced. IR35 contract assessments are reviewed by one of our experienced IR35 specialists who have a wealth of.

Contractors who are caught by IR35 pay significantly more tax. Having a IR35 contract assessment is an excellent way of demonstrating that you have operated due diligence in determining whether you operate outside of IR35 or not. They may also be known as the engager hirer or end client.

Interim Partners can help your business through the COVID-19 pandemic with interim staff across a number of sectors - especially those worst hit by the pandemic such as healthcare retail travel and manufacturing. Whether you are direct to client or via an agency the IR35 determination of your assignment is going to be out of your hands. This can reduce the risk of penalties being applied if your status is subsequently challenged by HMRC.

But the legislation is highly complex and HMRC often attempts to categorise contractors within its boundaries.

Ir35 Advice And Key Tips For Your Business

Freelancers Get Ir35 Savvy The Industry Club

What Is Ir35 Markel Direct Uk

What Does Ir35 2021 Mean For Sameday Couriers Da Systems

Ir35 Resolve Worsley Manchester Champion

Changes To Ir35 Legislation Gazelle Global Consulting

Freelancers Could Avoid Tax Because Of Ir35 Loophole Small Business Uk

Ir35 Claremont Consulting

Understanding Off Payroll Working Rules Ir35 Q Accountants

I11grng7vixcdm

What You Need To Know About Ir35 Comatch

Repealing Chapter 10 What Can We Expect From Ir35 In 2023 Ipse

Ersg Guide To Ir35 Legislation

Ir35 Archives Employer Perspectives

Ir35 What It Means To Freelancers And Self Employed Beb

Plt0oi5okllx5m

The Ir35 Reform 7 Key Challenges And How To Overcome Them Hr Strategy Hr Grapevine Insight